Solar Tax Credits Going Away…What the 2025 Tax Bill Means for Solar and Battery Incentives

As a solar installer based here in Arizona, we’ve always focused on helping our customers take advantage of the best incentives available to lower their energy bills and increase home value. But a new piece of federal legislation could soon make solar less affordable for many Arizonans.

The proposed “One Big Beautiful Bill,” which recently passed the U.S. House, includes major cuts to solar tax credits. If it becomes law, the bill would remove or reduce many of the financial benefits currently available to both homeowners and commercial property owners who go solar.

Changes to Residential Solar Incentives

Right now, homeowners can claim a 30% federal tax credit for solar or battery storage systems. This incentive has made solar much more accessible for families across Arizona. Under the proposed bill, that credit would expire on December 31, 2025, with no gradual phase-out. This means your system has to be installed and turned on by APS to qualify. Depending on the system and jurisdiction, it can take 3+ months from a signed agreement to a completed installation, so it’s important to act quickly.

In addition, the bill would disqualify leased solar systems from any federal tax credit at all. That could affect a significant number of households who prefer low-upfront-cost solar options.

Changes for Commercial and Business Solar Projects

The proposed tax bill would also phase out commercial solar tax credits faster than previously scheduled. The bill terminates the clean electricity tax credits for projects that do not “commence construction” within 60 days of the bill’s enactment. All qualifying facilities must be operational by December 31, 2028, eliminating the previously planned phasedown schedule. Rooftop Solar can help estimate, propose and “commence” construction in order to secure the commercial tax credits for your business.

The bill also ends incentives meant to support U.S.-based solar panel manufacturing, which could increase costs and create uncertainty in the supply chain.

How Arizona is Affected

While federal incentives may be at risk, Arizona still offers strong state-level support, including:

- A 25% state tax credit, up to $1,000

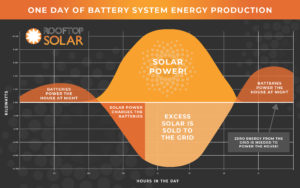

- Net metering policies for commercial utility credits and established buy back rates for residential systems.

Naturally, if the federal 30% credit disappears, solar installations will likely become more expensive overall. Planning early could mean tens of thousands of dollars in savings.

What Homeowners and Businesses Can Do

If you’re thinking about going solar, the most important takeaway is this:

Act Now: Get a free estimate and get started to secure your 30% credit.

To qualify for the 30% tax credit your system must be installed and turned on (by the utility) by December 31, 2025. Installing your system can take months from signing the agreement, design and permitting and installation. There is still time to act but waiting too long could mean missing out entirely, especially as equipment costs fluctuate and installation timelines fill up.

At Rooftop Solar, we can help you understand your options and get everything lined up—design, permitting, financing, and install—before the deadline.

Contact your representatives to let them know you support solar!

There is still time to make your voice heard. The elimination of solar tax credits as proposed will have a dramatic impact both on the solar industry and on your return on investment. Like many other industries, these incentives help customers invest in their homes and business, while offsetting utility bills and carbon impact with renewable energy. Your voice matters now more than ever: Click here to take action: (insert link to contact local representatives. )

It’s easy to know if solar makes sense for you. Start the conversation.

If you’d like to see what solar could look like for your home or commercial property, we’re here to help. We’ll provide a clear proposal with pricing, incentives, and financing options that make sense for you—without pressure or gimmicks.