Great news for solar homeowners! The federal solar tax credit has been extended for 10 years as a part of the Inflation Reduction Act signed into law last week. This is huge news as the solar tax credit is a massive part of the solar investment, and it has never been extended for this long.

There are other significant provisions in the act that positively impact renewable energy advocates and solar homeowners both directly and indirectly. Read on to find out more about the federal solar tax credit and about these other provisions and how they positively impact Americans.

- Extension of Federal tax credit at 30%

- Additional Adders for American-made equipment and low-income households

- Solar Battery Storage Tax Credit

- Energy Efficient Home Improvement Credits

- New Renewable Energy Rebates

- Electric Vehicle Tax Credit

Extension of 30% Tax Credit Until 2033

The federal tax credit for solar has been extended for 10 years back at the original rate of 30% of the total solar purchase. This applies to all components of the solar installation as well as other renewable energy sources like wind. The best news? This credit retroactively applies to all jobs completed in 2022!

It is important to choose a solar company like Rooftop Solar that provides custom systems to own It’s important to remember that a system provided via a solar lease will not qualify for this tax credit and can make the home harder to sell.

Additional Adders

There are a few adders, each worth an additional 10% of the total cost of the system, which can be added to the federal solar tax credit. A customer who qualifies for all three of these will receive a 60% tax credit. A 10% adder to the tax credit is provided for projects that meet specific requirements for domestic manufacturing. These requirements may be difficult to reach with some projects initially, but along with other provisions, the requirements are expected to incentivize growth in domestic manufacturing.

There is also a 10% adder for projects that are located in what were known as ‘energy communities’. These are defined as areas associated with a heavy dependence on fossil fuels like the Navajo Nation.

Lastly, there is a 10% adder for projects that sell their electricity via community solar projects to low-income individuals. This may not apply to the average homeowner, but some homeowners could see the full 60% solar tax credit.

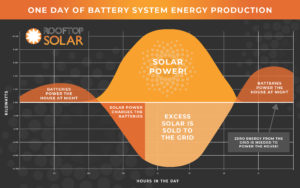

Solar Storage Tax Credit

The 30% federal tax credit also applies to home battery storage for new and existing solar projects. In the past, the credit has only covered storage products installed with new systems, but now, current solar homeowners can add batteries and take advantage of the same great storage incentives. This is an important point as solar storage is seen as the next big phase of our energy transition away from fossil fuels. In addition, newer technologies like Tesla’s Power Wall have made energy storage significantly more practical for many homeowners.

Energy Efficient Home Improvement Credit and Rebates

New energy-efficient products including doors, insulation, and circuit panels will qualify for the new Energy Efficient Home Improvement Credit. This tax credit applies in varying amounts for each improvement and can be taken any year until 2032. Some items, like heat pumps, are exempt from per-item or per-year maximums while other improvements have caps.

This will act as a huge incentive for homeowners and manufacturers alike, especially as it applies to big-ticket items like water heaters and electric cooktops. A fully electric home is more practical than ever!

Electric Vehicle Tax Credit

The Inflation Reduction Act contains a provision for a $7500 tax credit for purchases of new electric vehicles starting in 2023. In addition, purchases of used electric vehicles will qualify for a $4000 tax credit. Experts believe this used electric vehicle tax credit will be huge in making the energy transition as more people from a wider economic range will be incentivized to make the switch.

The numerous provisions in the Inflation Reduction Act that deal specifically with energy efficiency and solar power will have a real material impact on many Americans. This historic extension of the federal tax credit is accompanied by an extension of storage incentives, new energy-efficient rebates, and a credit for electric vehicles.

These extensions make now a great time to invest in solar, and Rooftop Solar experts can help you understand how these incentives specifically apply to you. Reach out today for a solar quote and start saving!

See More: https://www.pv-magazine.com/2022/08/15/whats-in-the-inflation-reduction-act-for-the-solar-industry/