Update: Congress has passed the Inflation Reduction Act, extending the federal solar tax credit for the next 10 years back at the original rate of 30%. This is great news for the solar industry and will even apply to installations already completed this year.

Next year, in 2023, there are a couple of changes coming to solar savings. Arizona Public Service is expected to revisit its yearly rate case with the Arizona Corporation Commission and try to lower its solar buyback rate by 10%. In addition, the federal government is planning to lower the solar tax credit by 4%.

The good news is there is still time to avoid both of these reductions, and the current rates can be secured for 10 years. Read on to find out why these incentives are so important to your solar investment, and why Rooftop Solar is the best place to get informed and make the switch!

APS Decreasing Solar Buyback by 10%

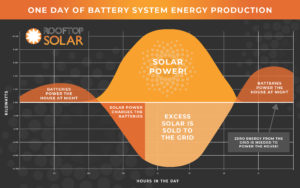

APS has asked for and been granted a decrease in the solar buyback rate in 4 of the last 5 years. While APS has made no announcements this year, they are expected to once again ask for a 10% decrease. As a part of this agreement, APS grandfathers all customers for 10 years into the rate at the time of the submission of their solar plans.

This means Rooftop Solar can submit your solar designs before August 31st, 2022 to get you the current rate of 9.4 cents per kilowatt-hour. The buyback rate is one of the main factors that determine the return on investment that you can expect from your solar system.

Solar Tax Crediting Dropping from 26% to 22%

The federal solar tax credit has had a significant impact on solar investment since its inception in 2005. The tax credit is currently scheduled to drop by 4% next year, from 26% to 22% of the total investment.

The tax credit is taken against your tax liability and applies to every aspect of the solar purchase or loan. It is important to go solar with a company like Rooftop Solar which allows you to own your own system. Homeowners who have signed a solar lease do not see the full advantage of their tax credit. It is also important to go solar with a company like Rooftop Solar which has 13 years of experience in the industry and can walk you through claiming the credit.

The solar tax credit is available to solar homeowners for their primary or secondary residence, and there is no limit to how much can be applied. In addition, the tax credit can be taken over the course of up to 5 years if you owe less tax than the full credit. Many solar owners will choose to reinvest these savings into the solar loan itself, and many others use it for other projects.

There are still plenty of savings to be had by going solar in Arizona, and it remains one of the best states in the nation to do so. Reach out to get in on the current APS buyback rate. Do it with a company like Rooftop Solar so you can have the complicated parts taken care of and you can focus on enjoying saving money and the planet!