As we reported last year, the Inflation Reduction Act was passed in August and extended the federal solar tax credit for the next 10 years at the full 30% rate. As tax season is upon us, read on to find out more about how the solar tax credit works, its benefits, what improvements have been made, and how to get more information.

Renamed and Extended

The Inflation Reduction Act, now called the Residential Clean Energy Credit, added a number of provisions to the clean energy credit. The primary improvement to the tax code impacting interested solar homeowners is the extension of the tax credit at 30% for the next 10 years. The credit, which started in 2006, has since been one of the strongest drivers in the solar industry and is what makes solar make sense for many people. The credit was scheduled to be phased out and then ended in 2024, but the Inflation Reduction Act contained the necessary provisions to extend and enhance the credit.

The tax credit offsets your tax liability thereby lowering your tax bill. If the allowed credit amount exceeds the amount of tax you owe, you may claim it in consecutive years indefinitely. In order to claim this credit it is imperative to own your system rather than lease it. You can read more about leasing vs buying in our article Leasing vs Buying Solar Panels.

Additional Provisions and Enhancements

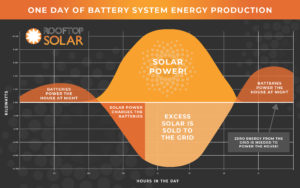

The Residential Clean Energy Credit also provides several other benefits including credits for solar battery storage and electric vehicles. The solar storage tax credit is a major shift as it will do a lot to push interest in batteries, the next huge leap in the transition to energy independence.

Enhancements in the form of 10% adders to the base 30% tax credit may also be applied. These provisions include a credit for products made domestically and a credit for people living in designated ‘energy communities’ disenfranchised by the shuttering of independent energy sources that they have depended on. There is also a 10% adder for anyone participating in a community solar project that sells power back to low-income areas.

In addition to the credits, several rebates are available for energy efficiency improvements made in the home. This makes a fully electric home more feasible and solar makes even more sense when you couple it with energy savings. You can read more about these requirements as well as more about the electric vehicle tax credit here: https://rooftopsolar.us/federal-solar-tax-credit-extended-for-10-years/.

If you installed solar in 2022, you will want to file an IRS form 5695 to claim your credit this tax season. The Inflation Reduction Act is the largest climate bill in history and will benefit the transition to a more sustainable energy future for years to come.

You can save money, gain energy independence, and do your part for a sustainable future. Let Rooftop Solar help you find out if solar is right for you!